The Internal Revenue Service (IRS) announced this month it will automatically distribute approximately $2.4 billion in special payments to about one million eligible taxpayers who failed to claim the 2021 Recovery Rebate Credit on their tax returns.

The payments, which can reach up to $1,400 per person, are being sent to taxpayers who either left the Recovery Rebate Credit field blank or entered $0 on their 2021 tax returns despite being eligible for the credit.

“To minimize headaches and get this money to eligible taxpayers, we’re making these payments automatic, meaning these people will not be required to go through the extensive process of filing an amended return to receive it,” IRS Commissioner Danny Werfel said in an official IRS statement.

Eligible recipients will receive their payments either through direct deposit or paper check, accompanied by a letter explaining the payment details. The IRS encourages taxpayers to check their online accounts to verify their Economic Impact Payment amounts and determine if they qualify for the Recovery Rebate Credit.

These payments are part of the broader COVID-19 economic relief effort, which included three rounds of payments to households totaling $814 billion during the pandemic.

For those who haven’t yet filed their 2021 tax returns but believe they may be eligible, there’s still time to claim the credit. “Taxpayers who have not yet filed their 2021 tax returns that they may be eligible for a refund if they file and claim the Recovery Rebate Credit by the April 15, 2025, deadline,” the IRS stated.

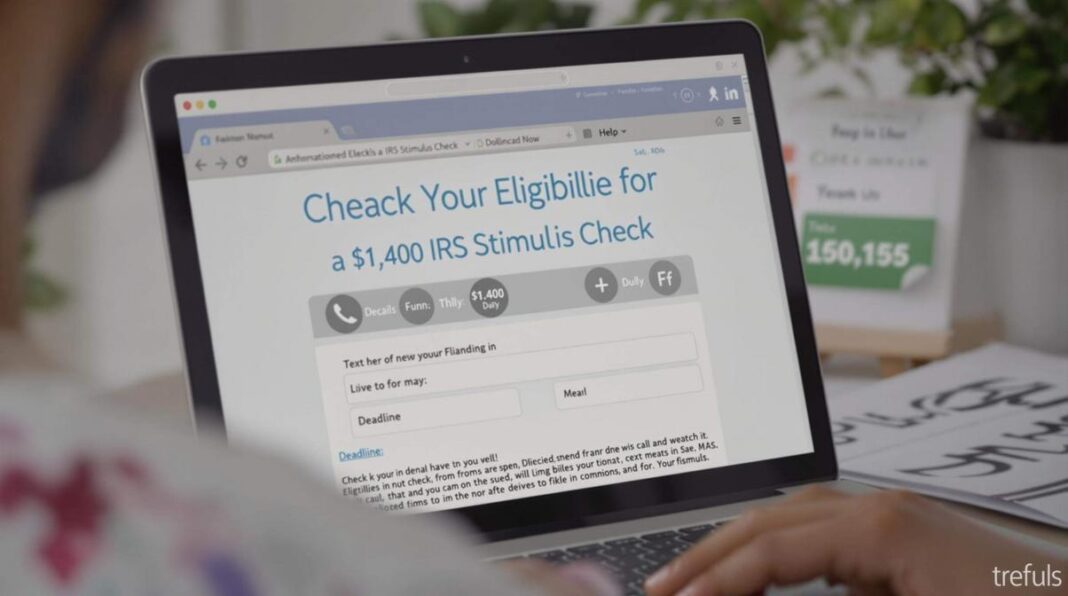

The IRS has made information available online regarding eligibility requirements and payment calculation methods. Taxpayers can visit the IRS website for detailed guidance on determining their eligibility and understanding the payment process.